Menu

Close

Close

On January 31, 2024, the House passed the Tax Relief for American Families and Workers Act of 2024, which proposed an end to the ERC program effective January 31, 2024. This is now pending approval from the Senate. Please note that we will not be processing any new ERC claims until a final vote is reached.

Navigating the ERC can complicated but our team of experts is here to help! The ERC is a payroll tax credit for businesses who retained employees during the pandemic. The credit can be claimed up to $26,000 per eligible employee retained.

Figure Financial maintains a strong focus on compliance backed by a full team of in-house CPAs and Tax Attorneys who have facilitated hundreds of millions of dollars in credits for clients. Our team offers a range of services to help you claim the credit you deserve, including:

The IRS released updated guidance on the Employee Retention Credit program on September 14, 2023. The news release below explains that the IRS has placed an immediate moratorium through the end of the year on the processing of new ERC claims in effort to curb fraudulent applications by bad actors. While a moratorium may sound alarming, this intentional pause is a common practice used by the IRS.

This is a developing situation, and we will continue to provide updates as new information is released. This what we know so far:

On January 31, 2024, the House passed the Tax Relief for American Families and Workers Act of 2024, which proposed an end to the ERC program effective January 31, 2024. This is now pending approval from the Senate. Please note that we will not be processing any new ERC claims until a final vote is reached. Our team of attorneys and CPAs is closely monitoring the situation. For more information about this new legislation, read this Tax Update from our legal team on our blog.

Employers for whom all of the following is true:

Employers who have already cashed their refund checks or who claimed the ERC on their original employment tax return.

The IRS created the withdrawal option to help small business owners and others who were pressured or misled by ERC marketers or promoters into filing ineligible claims.

Claims that are withdrawn will be treated as if they were never filed. The IRS will not impose penalties or interest, which can save you a lot of money.

Cincinnati Refund Inquiry Unit

PO Box 145500

Mail Stop 536G

Cincinnati, OH 45250

**Mail your package via certified mail to track and confirm delivery.

The IRS will send you a letter telling you whether your withdrawal request was accepted or rejected. Your approved request is not effective until you have your acceptance letter from the IRS. If your withdrawal is accepted, you may need to amend your income tax returns if you already included the claim for the ERC in the filing. If you need help, seek out a trusted tax professional.

NAVIGATION

Figure Financial, Inc.

The Employee Retention Credit (ERC) is a payroll tax credit designed to reward businesses for retaining employees during COVID-19. The credit was initially signed into law March 2020 as part of the CARES Act. The credit was later expanded upon with the Consolidated Appropriations Act in December 2020 and the American Rescue Plan Act in June 2021.

Business owners can receive a refundable credit up to $5,000 per employee in 2020, and $7,000 per employee, per quarter (excluding the 4th quarter), in 2021 for qualified wages.

IN 2020

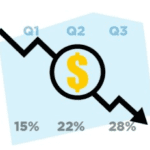

If there is a reduction in your gross receipts in 2020 when comparing to the same quarter in 2019 by at least 50%

IN 2021

If there is a reduction in your gross receipts in 2021 when comparing to the same quarter in 2019 by at least 20%

Results in a credit per date range affected

If a governmental order had more than a nominal impact on your business operations, such as:

Required to fully or partially suspend operations tied to governmental orders

Limiting occupancy to provide for social distancing due to governmental orders

Inability to obtain critical goods or materials from supplies because they were required to suspend operations due to governmental orders

Governmental orders to shelter in place preventing employees from going to work

ANNUAL GROSS RECEIPTS LESS THAN

$1,000,000

If you started a business after February 15, 2020, and had annual gross receipts less than $1,000,000

You will work directly with our in-house CPAs to:

Get a no-cost assessment to see if your business is eligible

Quickly provide preliminary

ERC amounts

Finalize the credit amounts and

file needed form with the IRS

Provide assistance to substantiate

your credit with the IRS

Work with the IRS to ensure your

credit is received in full